There’s a lot of hoo-har over that utter shitshow that is Brexit and some of it is due to the many levels of bureaucracy forced upon British exporters now we’re no longer in the EU. This, of course, despite the promises by the Brexshitters that leaving would get rid of all that red tape and make us more prosperous.

Well that same degree of fuckwitted belligerence applies to HMRC. A few years back, they decided that it would be a good idea to roll out a new policy called “Making Tax Digital”:

“Making Tax Digital is a key part of the government’s plans to make it easier for individuals and businesses to get their tax right and keep on top of their affairs.”

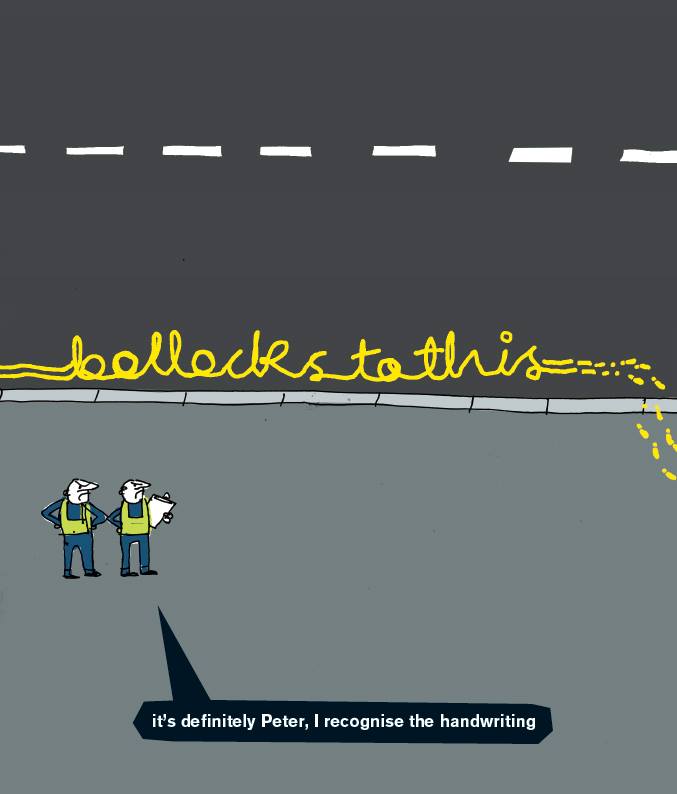

Utter bollocks!

Originally, there was a threshold for turnover before you’d be forced to submit VAT returns in the way the HMRC demanded, but that threshold was shelved, so now, if you’re VAT-registered than you have to submit them their way. The roll-out was delayed by COVID-19 – who knows why – but it’s up and running now.

I was self-employed for many years and was VAT-registered as 95% of the work I was doing was B2B (business to business). For the last 14 years I’ve been employed but still do a minimal amount of work freelance, so I charge VAT and claim it back on the expenses I incur.

Copies of all invoices in and out are stored in folders on my computer (and backed up) and the calculations for my VAT returns (and indeed Self-Assessment) are entered manually on a spreadsheet. I used to then enter the numbers on the VAT return online and voila! Straight after the end of the VAT period, in they went and I either paid out the VAT or reclaimed it.

But not any more. I’m not allowed to do this myself. I have to keep records (like I already do) with an ‘audit trail’ (like I already do) but now I have to link my numbers through to a new spreadsheet or solution offered by one of the 196 providers of this so-called “bridging software”. By “offered” I mean “sold” either on a one-off basis or more often on an ongoing basis, costing hundreds of pounds a year … off my profit. That’s if the software works on your system: PWC’s, for instance, only works on a Windows computer and not a Mac, and costs £144 a year. At least PWC say how much it is; some of their competitors don’t.

I’m away for a few weeks overseas every few weeks (in the EU and back four of five times a year) and as I’m writing this, I’m ready to submit a VAT return but cannot because the HMRC will only send my new username and password to me by post and I need to enter that in the bridging software so that my figures from my spreadsheet go via another spreadsheet to HMRC’s VAT portal.

You know, the one I used to copy the numbers into before and for zero extra cost…

You must be logged in to post a comment.